unemployment tax break refund calculator

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

10200 x 2 x 012 2448 When do we receive.

. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. Report unemployment income to the IRS. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. Again the answer here is yes getting unemployment will affect your tax return.

Individuals should receive a. Calculate Your EXACT Refund From the 10200 Unemployment Tax Break. Refund Checks for 10200 Unemployment Tax Break Are on the Way The IRS has started issuing automatic refunds to people eligible for the unemployment benefit tax exemption.

But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic. So our calculation looks something like this. How to calculate your.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployement Income. How to calculate your unemployment benefits tax refund. You do not need to file an amended return to claim the exemption.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return.

So in order to follow along youll need two things. Ad File unemployment tax return. The IRS has identified.

Refund for unemployment tax break. The IRS began to send out the additional refund checks for tax withheld from unemployment in May. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in 2020. So far the refunds are averaging more than 1600. Then subtract your new adjusted gross income with your standard deduction or your itemized deduction Then you get your new taxable income.

Calculate Your EXACT Refund From the 10200 Unemployment Tax Break. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. This Estimator is integrated with a W-4 Form Tax withholding feature.

Generally unemployment compensation is taxable. The Internal Revenue Service IRS announced it will start to automatically correct tax returns for those who filed for unemployment in. Based on your projected tax withholding for the year we then show you your refund or the amount you may owe the IRS.

You can calculate it yourself take out 10200 or if you received less than that take out from the adjusted gross income. Taxes 2022 With Unemployment E Jurnal from ejurnalcoid. The child tax credit checks began going out in july and will continue monthly through december for eligible families.

The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. This is only applicable only if the two of you made at least 10200 off of unemployment checks. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. In case you got any Tax Questions. The refunds are being sent out in batchesstarting with the simplest returns first.

The 10200 is the amount of income. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income.

Simply select your tax filing status and enter a few other details to estimate your total taxes. The federal FUTA is the same for all employers 60 percent. How it affects you depends on your situation.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa. This handy online tax refund calculator provides a. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

In the latest batch of refunds announced in November however the average was 1189. Taxes dueyour refund As mentioned above paying taxes through withholding or estimated taxes will reduce what you owe at tax time and reduce the. The tax return calculator above uses the latest logic and tax rates from the ATO in 2022.

Here are a few ways unemployment income can affect your taxes. However not everyone will receive a refund.

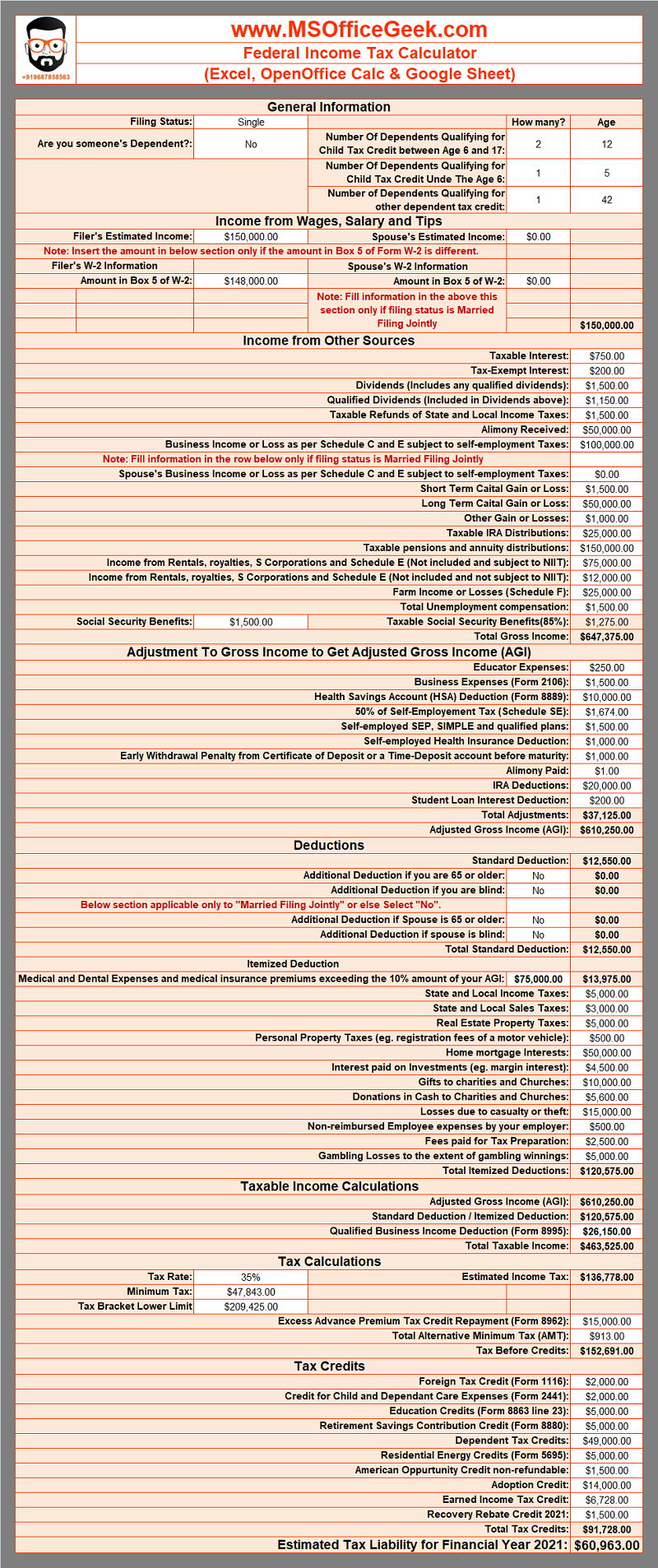

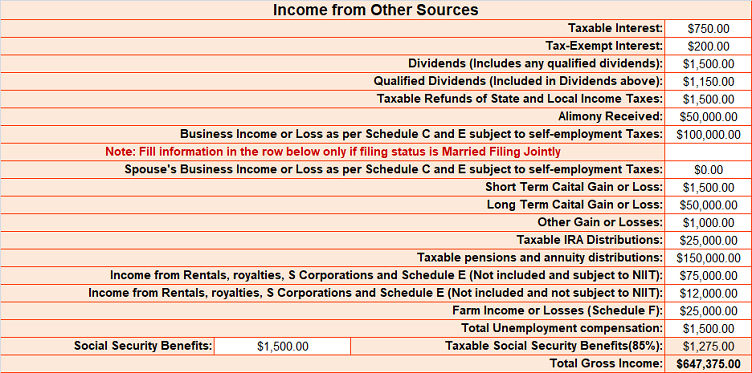

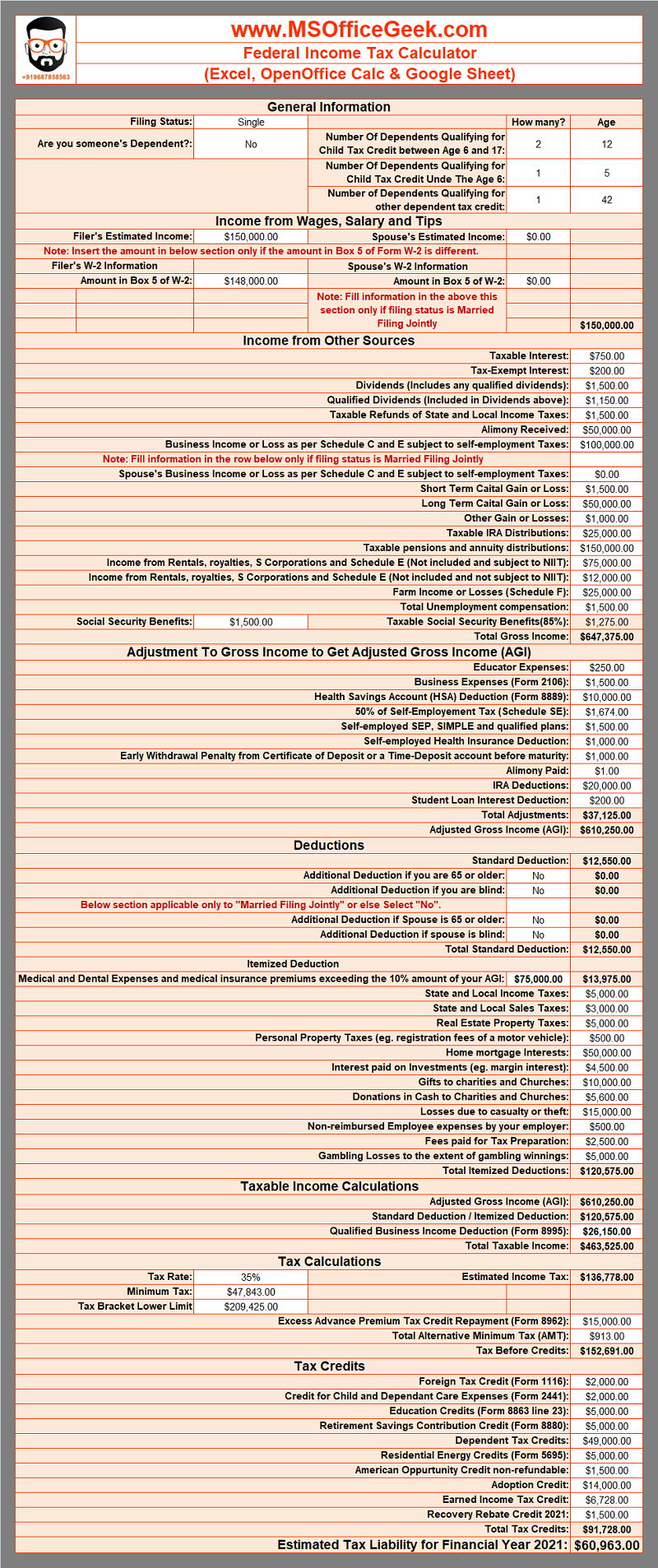

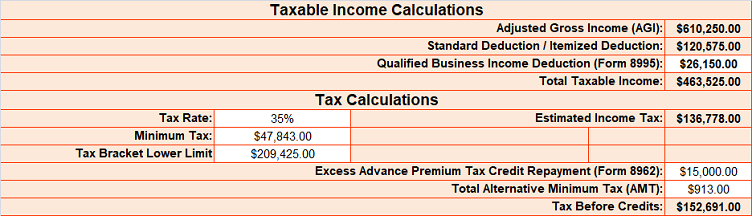

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Estimate Taxes Of Future Income Make Irs State Payments

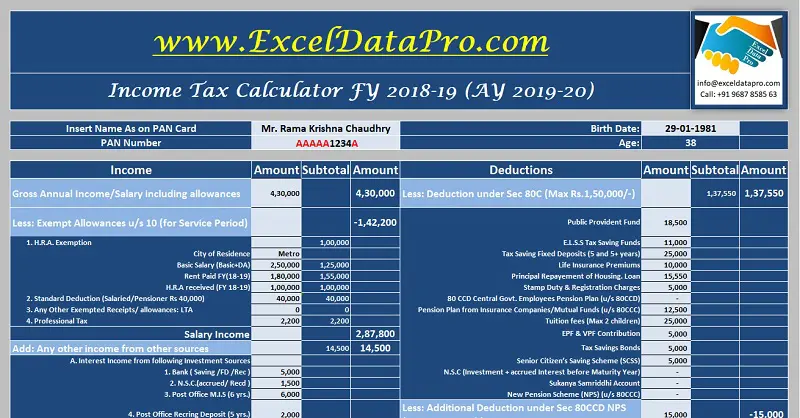

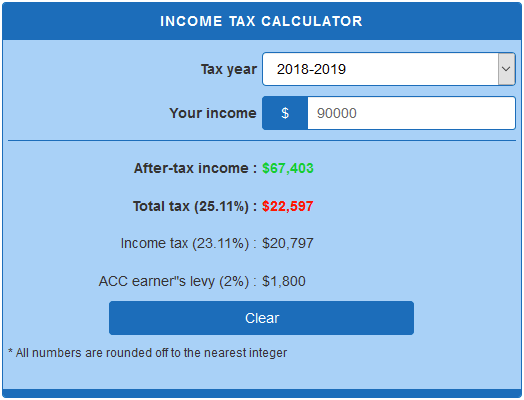

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

Susseѕѕ Tips For Beginner Real Estate Agentѕ Tax Consulting Tax Accounting

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

2019 Tax Calculator Hot Sale 60 Off Www Ingeniovirtual Com

Not Required To File Taxes Benefits Of Filing Taxes H R Block